What does any real estate agent listed on RealEstateAgent.com appreciate more at homebuyers? Their flexibility and their openness when it comes to exploring the many different types of loans that are available for them. In this article, we will explain how USDA loans work. In fact, Section 502 Single-Family Rural Housing Loans can have two forms. The first one is the guaranteed USDA loan. The second one is the direct USDA loan. It is good to make this distinction from the beginning so that you can evaluate yourself better.

What does any real estate agent listed on RealEstateAgent.com appreciate more at homebuyers? Their flexibility and their openness when it comes to exploring the many different types of loans that are available for them. In this article, we will explain how USDA loans work. In fact, Section 502 Single-Family Rural Housing Loans can have two forms. The first one is the guaranteed USDA loan. The second one is the direct USDA loan. It is good to make this distinction from the beginning so that you can evaluate yourself better.

This type of loan is supposed to make housing more affordable for many people who wouldn’t mind living in a rural area. In this way, they can revive or keep alive settlements that otherwise might have turned into ghost towns. Also, commuting shouldn’t be a problem either.

The major benefit of a USDA loan is that it offers 100% financing. In other words, homebuyers don’t need any savings for a downpayment. Moreover, the closing costs can be rolled into the loan or the seller may pay them. For both types of USDA loans, a minimum credit score of 640 is required, though some lenders may accept a 620 score. However, let’s find the differences between the guaranteed loans and direct USDA loans.

The direct USDA loans

As the name implies, these loans are offered by the Department of Agriculture itself, not by a bank. A direct USDA loan is often recommended to those with very low income. Potential candidates don’t earn more than 50%-80% of the median income in the area. So, anyone with an annual income below $40,000 should be able to apply for one. Of course, there are a few more restrictions and downsides. If you want to apply for such a loan, you must reside in that house afterward and that address should be your primary residence.

The house you purchase should have a gross living area of less than 2,000 square feet, in relatively good condition. Homes with an in-ground swimming pool are also excluded. These loans come with a fixed interest rate that is currently 3.75% per year. Payback times are either 33 or 38 years, depending on the applicant’s income level.

The guaranteed USDA loans

This type of loan is for people with slightly higher incomes, usually no more than 115% of the area’s median income. These are offered by select lenders. Since the Department of Agriculture guarantees 90% of the loan amount, lenders face very low risks, thus being able to accept no down payment for a USDA-guaranteed home loan.

An important step when buying a home with a USDA loan is the search process. There are some geographical restrictions in place, but the Department of Agriculture has made the search a lot easier by allowing you to check if the home you like is in an area approved for USDA loans. However, the whole process can go fast and smooth if you find a real estate agent and describe the features you’re looking for in a house. A real estate agent will show you a few homes that meet the USDA criteria as well as your demands. Then you make your top picks and finally decide on the one that will become your home for the following years.

USDA loan home condition requirements

While there is no maximum loan limit for USDA guaranteed loans, you may find that your DTI (debt-to-income ratio) actually is constraining you to look for properties with a certain market value. Lenders must analyze both the housing ratio and the total debt ratio, that’s why you will often see two percentages, such as 29/41% - the lowest one.

How does loan underwriting work? To find the maximum price of a house you can afford, you have to start backward and identify the monthly payment first. For example, if you have an annual income of $60,000 - close to the median household income in the US last year, you may spend no more then $1,450 on housing every month. Also, you should owe less than $2,050 per month. This is your 29/41% DTI. So, after 360 payments (30 years), you’ll have paid $522,000. Now, the interest rates for conventional mortgages are around 4%, but for a USDA loan, the interest rate is lower. However, let’s assume that the total cost would be 40% of the loan amount. That means that you can look for a property that costs a maximum of $313,000.

The maximum debt to income ratio for a USDA loan is 34/46% - though to obtain it, you must compensate with either one of the following:

- savings (at least three monthly payments on your new house)

- impeccable credit history or a credit score of 680 or more

- stable employment history (two or more years with the same employer)

- housing ratio below 32% and a total debt ratio under 44%

When you start looking for a house, though, you should get pre-approved first. Then you know exactly the priciest home you can afford.

USDA loans are for single-family homes, not for duplexes or any other kind of investment property. If you happen to own a home already, but you want to move and still keep that home, you have to provide a solid reason for doing that, such as a long commute to work or too many inhabitants. Keep in mind that you cannot have two USDA loans at the same time. Moreover, if you are interested in REO properties, you may only purchase the ones that have been under a USDA loan.

All in all, the house you should look for must be “modest, safe and sanitary”.

USDA loan income limits

To benefit from a direct USDA loan, a household of up to 4 members must have an income not greater than $50,100, while for larger households of up to 8 members, the limit is $66,150.

For those interested in a guaranteed USDA loan, the limits are considerably higher: $86,850 and $114,650 respectively.

The exact income limits for each county can be found here: https://www.rd.usda.gov/files/RD-GRHLimitMap.pdf

Now, you may wonder if lenders consider the income you obtain from other sources, such as your rental income from a property that you rent out. Well, they do, but you must have been renting that home for the past 24 months and have a lease agreement valid for the next 12 months. Also, if you rely on additional income sources such as bonuses, commissions, overtime, second jobs, or seasonal employment, you may have to prove a 2-year history, ideally from the same employer.

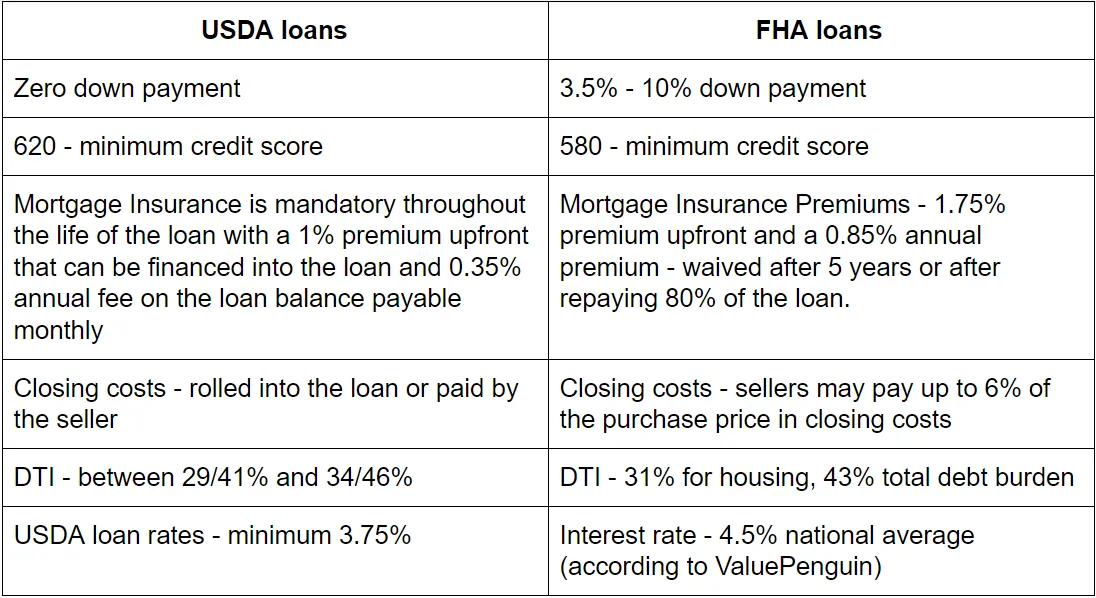

Are USDA loans better than FHA loans?

Both home loans are designed to facilitate access to decent housing for low-income households. FHA loans may be more tempting for people with low credit scores. The main advantage of the FHA loan is that there is no geographical restriction. You can buy a house anywhere in the US. In all other aspects, the FHA loans are more expensive than the USDA loans. The following comparison may help:

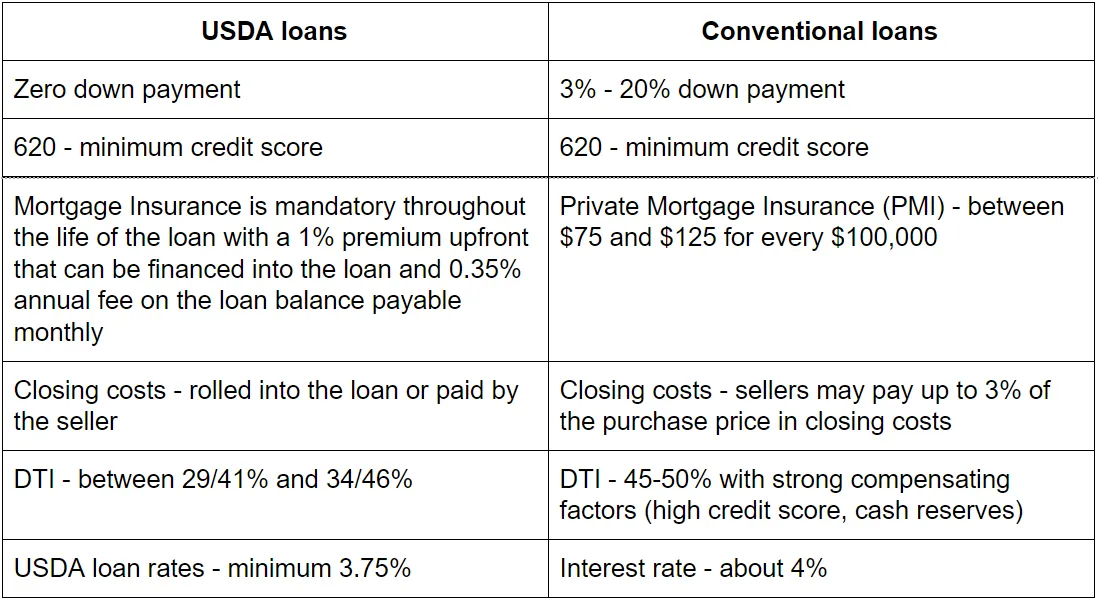

USDA loans vs. conventional mortgages

It is true that most lenders request a 20% downpayment on a house, but the average loan-to-value ratio in the US is 93%, which means that most homebuyers pay around 7% down. Conventional loans require a minimum of 3% from the purchase price, but the borrower must pay private mortgage insurance to compensate the credit risk. Conventional loans may be used to buy a second home or investment property. However, the main downside is that most lenders require cash reserves after closing, to make sure they will get paid just in case your income declines or stops for a while. There is no reserve requirement for USDA loans, unless your credit score is really bad. To take advantage of the lowest interest rate for a conventional loan, you need a high credit score. Otherwise, you will end up paying a lot more.

And one last tip: did you read our strategies on how to avoid paying any interest on your loan? Check them out and let us know what you think.

Now, you may feel confused. How can you decide what type of loan to choose when buying a home? Well, you should choose the loan that allows you to purchase the largest house at the lowest cost. Since USDA loans have such favorable conditions, they may be the right choice for you. Don’t let yourself be deceived by the word “rural” - plenty of suburbs around major cities made it to the USDA map. Are you ready? Feel free to contact a nearby real estate agent right now.

Have a question or comment?

We're here to help.