How did the evolution of real estate begin? Which were its most (in)famous ups and downs? What will the future bring? The real estate market in the United States has a long and illustrious history. Over the decades, it has seen incredible changes. From the early colonial days to today's modern market, real estate has become indispensable to American life. Are you in pursuit of the American Dream? Then, you must own a home first!

How did the evolution of real estate begin? Which were its most (in)famous ups and downs? What will the future bring? The real estate market in the United States has a long and illustrious history. Over the decades, it has seen incredible changes. From the early colonial days to today's modern market, real estate has become indispensable to American life. Are you in pursuit of the American Dream? Then, you must own a home first!

I invite you, dear reader, on this fascinating journey to explore the one-of-a-kind evolution of the real estate industry. Hopefully, we'll get one step closer to understanding its 2024 state!

Get one step closer to your real estate dreams!

Understanding real estate market cycles is essential for homebuyers, sellers, and zealous property investors to make the best decisions. Is your city a seller's or buyer's market? Will real estate comps jive with your home buying or selling dreams? In the 21st century, only the most accurate Information is power.

Would you like to get the most up-to-date housing alerts on real estate market cycles? Then, reach out to real estate agents directory members! Our team of experts keeps its fingers on the pulse of historical trends. With over twenty years of experience, RealEstateAgent.com has successfully connected agents with clients. The news, tips, and tricks their agents and realtors provide have proved critical to a triumphant closing.

The early days: Colonial times to the 19th century.

It's always exhilarating to turn our eyes back and follow the history of farmlands to modern neighborhoods. Unmapped lands and unchartered corners of The New World launched a genuine frenzy amongst the first settlers. Thus, owning a piece of land was one of the most valuable assets in the colonial period. Not much has changed since then.

It's always exhilarating to turn our eyes back and follow the history of farmlands to modern neighborhoods. Unmapped lands and unchartered corners of The New World launched a genuine frenzy amongst the first settlers. Thus, owning a piece of land was one of the most valuable assets in the colonial period. Not much has changed since then.

The early settlers needed it for farming and building homes. The land was abundant, and acquiring it was relatively straightforward. Why, I hear you say. The government often gave land to settlers as an incentive to move westwards and conquer more. A financially intelligent move as property taxes became a standard practice.

By the 19th century, things began to change. The Industrial Revolution brought about rapid urbanization. People moved to cities for jobs, and demand for urban real estate soared. This period saw the rise of real estate as a business. Buying, selling, and developing land became more sophisticated.

The birth of the modern real estate market

Slowly, we enter one of the most determining stages of the evolution of the real estate industry. The late 19th and early 20th centuries were pivotal. Real estate agents began to organize, and real estate boards were formed. This period also saw the birth of the National Association of Realtors (NAR) on May 12, 1908, in Chicago. This organization set the standards for ethical practice in real estate.

One of the greatest recessions in American history, the Great Depression (1929–1933), was a bleak watershed in the history of the real estate market. It led to the creation of the Federal Housing Administration (FHA) in 1934. The FHA helped stabilize the market by insuring loans and making homeownership more accessible. After World War II, the real estate market boomed. The GI Bill helped returning soldiers buy homes, leading to the growth of suburbs.

The boom and bust of the late 20th century

The latter half of the 20th century witnessed several real estate booms and busts, perfectly demonstrating how market cycles work. It started with the high-growth period of the 1970s. Then came the 1980s, which brought a bitter recession and high interest rates. The market cooled and became slippery like ice. The 1990s saw a resurgence with the development of new technologies and the advent of the World Wide Web. For this reason, real estate information has become more accessible.

The latter half of the 20th century witnessed several real estate booms and busts, perfectly demonstrating how market cycles work. It started with the high-growth period of the 1970s. Then came the 1980s, which brought a bitter recession and high interest rates. The market cooled and became slippery like ice. The 1990s saw a resurgence with the development of new technologies and the advent of the World Wide Web. For this reason, real estate information has become more accessible.

However, the most significant growth (and subsequent bust) came in the early 2000s. A questionable mix of low interest rates and easy credits (granted to buyers with low credit scores way too quickly) led to a housing bubble. Home prices skyrocketed, and homeowners couldn't keep up with their mortgage payments. Thus, the artificially inflated progress was not sustainable. The bubble burst in 2008, triggering the Great Recession. This crisis had a profound and lasting impact, leading to stricter lending standards and fundamental changes in the housing market.

The present-day: A (not-so) dynamic market

Today, the real estate market should be highly dynamic. Apparently, all the ingredients are given for a thriving market. For starters, digital technology plays a huge role. Online listings, virtual cyber tours, and digital transactions make buying and selling homes more accessible. The COVID-19 pandemic also changed the market; contrary to expectations, it initially revitalized it.

People sought more space, and many moved from big cities to suburban and rural areas. We can notice well-defined relocation patterns throughout the US, with the Sun Belt taking center stage. With all this interest in real estate, how come the American housing market reached a standstill in the 2020s?

What arrested the real estate progress?

The Federal Reserve, our central banking system, has been grappling with ongoing global inflation and fears of another recession. The FED was compelled to adopt austerity measures to stabilize the economy, which unfortunately led to a stagnant real estate market. One of its most controversial acts was the decision to hike interest rates, which ultimately had a detrimental effect on the real estate market.

As of 2024, sales have taken a back seat, property prices soared, and the housing crisis has become a sore roadblock. Many believe only a massive market correction can put the market back on track.

Real estate market cycles: Understanding the ups and downs

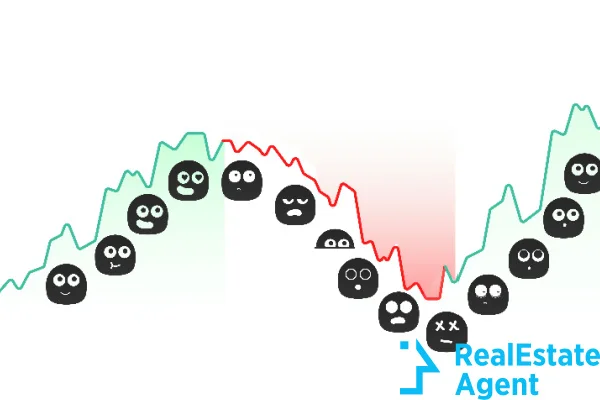

Like economic progress, the history of the real estate market doesn't move in a straight line. Instead, it goes through "rotations" with distinct phases:

Like economic progress, the history of the real estate market doesn't move in a straight line. Instead, it goes through "rotations" with distinct phases:

- Expansion: During this phase, demand for housing increases. Prices go up, and new construction starts. This phase is marked by optimism and enthusiasm for investments.

- Peak: The market reaches its highest point. Demand is high, but supply starts to catch up. Prices are at their peak.

- Contraction (or recession): The market starts to cool off. Demand decreases, and prices begin to fall. New construction slows down.

- Trough: The market hits its lowest point, and prices bottom out. This phase can be challenging but also presents opportunities for savvy buyers.

Various factors, such as economic conditions, interest rates, and population growth, influence market cycles. If you believe the 2024 stagnant housing market is unique, think again! History repeats itself. So, keep your eyes peeled for housing alerts, draw conclusions, and take measures to navigate the real estate market cycles and maximize their opportunities.

Why are housing alerts and market cycles vital in real estate?

Housing alerts play a significant role in the evolution of the real estate industry. They are cues that exhibit changes in market conditions from the start. For example, rising interest rates might signal the end of an expansion phase. On the other hand, increased inventory can indicate a slowing market.

Housing alerts on real estate market cycles help buyers, sellers, and investors make decisions. By paying attention to these alerts, you can better time your actions. For example, buying during a trough can mean getting a home at a lower price, and selling during a peak can maximize profits. Working with professionals improves your chances of a well-timed transaction.

Wrapping our heads around real estate market research

Good real estate decisions are backed by solid research. But how is market research conducted?

Good real estate decisions are backed by solid research. But how is market research conducted?

Data Collection

The cycle of real estate market research starts with gathering data, including historical prices, sales volumes, rental rates, and economic indicators. Websites like Zillow, Redfin, and government databases are invaluable sources for this crucial step.

Analysis

Once you have the data, you need to analyze it. Look for patterns and trends. Are prices rising or falling? Is there a lot of new construction? Tools like spreadsheets or specialized real estate software can help.

Market segmentation

Real estate markets are not one-size-fits-all. They are dynamic and diverse. Different segments (e.g., residential, industrial, commercial, and luxury) can exhibit unique behaviors. If investing in residential or commercial real estate intrigues you, analyzing each segment is essential to gain a comprehensive understanding.

Comparative Market Analysis (CMA)

This involves comparing similar properties to determine a property's value. Realtors often use CMAs to advise clients on buying or selling prices.

Forecasting

Using historical data and current trends, try to predict future market conditions. No forecast is 100 percent accurate, but it can provide valuable insights. For instance, the 2024 real estate market forecast envisions a slight improvement in the year's second half, including decreasing interest rates and lower home prices.

The future of real estate

No one can stop the real estate market from evolving. It's like an independent entity. What do I envisage for its future? Imminent technologies like artificial intelligence and blockchain could revolutionize the industry. How about tomorrow? Will the US market recover? Interest and mortgage rates are normalizing shortly, more new constructions are coming, and the industry is counting on an inevitable market correction. The industry will soon enter the expansion phase of the real estate market cycle again.

No one can stop the real estate market from evolving. It's like an independent entity. What do I envisage for its future? Imminent technologies like artificial intelligence and blockchain could revolutionize the industry. How about tomorrow? Will the US market recover? Interest and mortgage rates are normalizing shortly, more new constructions are coming, and the industry is counting on an inevitable market correction. The industry will soon enter the expansion phase of the real estate market cycle again.

One crucial trend to watch out for is the spreading relevance of sustainability in real estate. This is not just a passing craze but one of those remarkable historical trends we'll remember in 50 years. The new generation of homebuyers prioritizes green buildings and energy-efficient homes, making sustainability a household name in the industry.

Conclusion

The market is a living, breathing entity that never ceases to captivate me. Its ever-changing nature is what makes it so intriguing and, yes, sometimes a bit baffling. But that's the beauty of it! The ups and downs, the highs and lows—all add an exciting piece of the puzzle to this fascinating industry. I know we've been mainly experiencing its dark side lately. Still, I genuinely believe there are bright days ahead for the US real estate market.

Undoubtedly, we've faced our fair share of challenges, from high interest rates to housing crises. However, it's important to remember that the market is cyclical. What goes down will eventually come up. As we witness the evolution of technology, with AI and digital real estate leading the way, I'm filled with optimism. These advancements promise to usher in an era of enhanced transparency and efficiency. Moreover, the growing emphasis on sustainability is fantastic and holds immense promise for future generations.

So, to all the dreamers out there, keep your eyes on the market trends! Stay curious, stay optimistic, and keep dreaming big!

What are your thoughts on the future of the real estate industry? Do you share our passion for the housing market? We'd love to hear from you! Leave a comment below, and let's continue this conversation. And, as always, show your support by giving this article a big thumbs up and sharing it on your social media platforms!

Have a question or comment?

We're here to help.