When one chapter ends, another one begins. Foreclosures are simply that: fresh new beginnings. Of course, it can bring you down for a while, it may have a negative impact on your credit score for years and even on your relationships, but you can rebuild your life and live happily ever after. Foreclosures are like a bad dream that for some homeowners becomes a reality. This unfortunate way to end a mortgage is quite predictable, but you can take steps to avoid foreclosure, like refinancing your mortgage with a foreclosure bailout loan. However, saving a house from being foreclosed upon by the bank is not always possible or desirable.

When one chapter ends, another one begins. Foreclosures are simply that: fresh new beginnings. Of course, it can bring you down for a while, it may have a negative impact on your credit score for years and even on your relationships, but you can rebuild your life and live happily ever after. Foreclosures are like a bad dream that for some homeowners becomes a reality. This unfortunate way to end a mortgage is quite predictable, but you can take steps to avoid foreclosure, like refinancing your mortgage with a foreclosure bailout loan. However, saving a house from being foreclosed upon by the bank is not always possible or desirable.

The US economy is booming right now, and this can be seen in the steep decline of the foreclosure rate - from a record high of 2.23% in 2010, close to its 2005 level at 0.47% in 2018. According to CoreLogic, between 2007 and 2016 there have been 7,783,000 foreclosures in the US, which means that roughly 15,000 Americans lost their houses every week. Foreclosures seem to be more frequent in coastal states, maybe due to the fact that many buy second homes or vacation rental properties in the spur of the moment only to realize a few years later that it’s harder to pay off than they had anticipated or that it takes quite a lot of resources to manage a rental property adequately. New Jersey, Delaware, and Maryland are the states with the highest number of foreclosures.

Common causes of foreclosure

Some causes are obvious, such as failing to respect the amortization schedule imposed by the lender. Once the loan is 121 days past due, foreclosure attorneys will be aware of your situation and will start the process. However, during this period, lenders are often informed of the following reasons behind late payments:

Some causes are obvious, such as failing to respect the amortization schedule imposed by the lender. Once the loan is 121 days past due, foreclosure attorneys will be aware of your situation and will start the process. However, during this period, lenders are often informed of the following reasons behind late payments:

- Negative equity - when the price of a house is in free fall, the borrower might find himself owing too much money than the house is worth.

- The 5 D’s - death, divorce, drugs, disease, denial

- Unemployment - no income, means no mortgage payments.

- Credit Card Debt - Shopping sprees, dining out and expensive holidays, all put huge financial pressure on a homeowner, especially on millennials - the first-time home-buyers, aged under 37.

- Sudden Relocation / Second mortgages - most of the times, moves are stressful, primarily when a second mortgage is contracted. It’s hard to ride two horses at once, so sooner or later, people in this situation lose a property either voluntarily, or not.

The cause of your foreclosure is probably in the list above. Did the foreclosure cure the cause? It probably didn’t, just like the common cold medication - it treated the symptoms, not the real problem. Government help after a foreclosure is also like the new patch on the old garment.

Do you still owe money after a foreclosure?

To further complicate things, if a property sold during foreclosure doesn’t cover the whole amount due, the difference is called a deficiency, so the borrower may still owe money to the credit institution. Depending on the state you live, lenders might be allowed to sue a borrower to recover the deficiency after foreclosure. Wage garnishments are the most common tool used to collect the outstanding debt, but lenders can also place liens on other properties that you own or freeze your bank accounts.

If you don’t want that debt to follow you, make sure you owe nothing to the lender once the foreclosure ends. In the case of a non-judicial foreclosure and when the loan is a non-recourse loan, the lender cannot go after your assets. However, nothing stops small banks and lenders to file new motions in old foreclosure lawsuits, hiring debt collectors to recover leftover debt, court fees, attorney’s fees and all the interest accrued over the years. According to a statement made by Rep. Elijah E. Cummings (D-Md.) in 2013 for Washington Post, “deficiency judgments compound the harms borrowers have already suffered.” The deficiency judgment is a legal process allowed in 40 states. Could these deter people from defaulting in the future?

If you can’t pay the deficiency, as a last resort, you can file for bankruptcy, but keep in mind that it will wipe another 150-200 points off your credit score and will stay on the records for approximately 10 years. Don’t worry, though! You can rebuild not only your life after a foreclosure but also your credit score.

What happens when a house is foreclosed on by the bank?

You already know the process, but for our readers who don’t know what it looks like, we will shortly point out the most important details. Generally, a foreclosure is a three-step process:

You already know the process, but for our readers who don’t know what it looks like, we will shortly point out the most important details. Generally, a foreclosure is a three-step process:

- Pre-foreclosure - the mortgagor receives a Notice of Default (NOD) from the lender and is given a reinstatement period, that usually lasts until five days prior to the real estate auction, the next phase. The NOD is issued by a trustee and recorded at the County Recorder’s Office.

- Auction - as you have guessed, the opening bid is equal to the outstanding loan balance. If no buyers show up or if nobody wants to place a bid higher than the opening bid, then the property enters the final stage of foreclosure and is deemed REO or Real Estate Owned.

- Bank Owned (REO) - there are real estate agents specialized in listing only REOs on the Multiple Listing Services, so the houses are back on the market just like any other house. However, the new buyer gets to know part of the history behind that listing. Some real estate investors are looking for distressed properties, and many find deals this way, but most banks and lenders want top dollars for the properties that linger in their portfolios.

From the outside, it looks like lenders are kind and merciful, giving debtors plenty of time to reinstate the mortgage and keep the house. However, when you are in that situation, the process seems excruciatingly long and painful. I met a few people who had received two or more offers from the lenders but were in such deep financial trouble that they couldn’t keep up with any repayment plan. Eventually, they had to short sale their houses and even file for bankruptcy.

Now, you can see that the glass is also half full, not only half empty. The good side of a foreclosure is that it allows you to start from scratch. It helps you to understand that you don’t have to own a house to be happy. Yes, housing is a major issue for all of us. We all need a roof over our heads, but any roof will work, even if it doesn’t have our name engraved on it. Renting after foreclosure is better than homelessness. I have moved seven times before 30, and I’ve learned to enjoy the little things. I’ve been through foreclosures together with my family. I know what it feels like. Miraculously, I’ve survived. And remember that what doesn't kill you only makes you stronger!

How much does a foreclosure change your credit score?

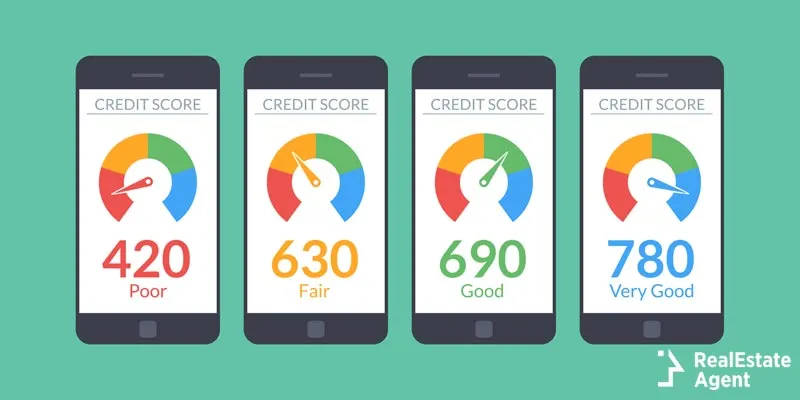

Do you know what else happens when a house is foreclosed on by the bank? It puts a black mark on your credit history. In the US, there are two important scoring systems - the FICO and VantageScore. The highest FICO score is 850, while on the VantageScore scale the maximum is 990 (for VantageScore 1.0 and 2.0; VantageScore 3.0 adopted in 2013 is between 300 and 850). Foreclosures knock as much as 140 points off your credit score. When you reach 500 points or less, it becomes more and more difficult to refinance a small car loan, and you’ll be unwelcome in most rental offices. Former homeowners are stigmatized by a number.

Do you know what else happens when a house is foreclosed on by the bank? It puts a black mark on your credit history. In the US, there are two important scoring systems - the FICO and VantageScore. The highest FICO score is 850, while on the VantageScore scale the maximum is 990 (for VantageScore 1.0 and 2.0; VantageScore 3.0 adopted in 2013 is between 300 and 850). Foreclosures knock as much as 140 points off your credit score. When you reach 500 points or less, it becomes more and more difficult to refinance a small car loan, and you’ll be unwelcome in most rental offices. Former homeowners are stigmatized by a number.

The lower the score, the more excluded you will feel from the credit economy of the present day. But the good thing in all this story is that you are forced to save money to buy more expensive stuff that you would have otherwise purchased with a credit card. Most people need to pass through a foreclosure to better appreciate every single dollar they bring home. From time to time we have to close the fist and keep some of the money that touch our palms, instead of letting all of it slip through our fingers…

Most foreclosures could have been avoided if the education system had taught basic personal finances and explained the banking system openly and honestly, thus helping all the students choose the right type of loan at the right time. On top of high tuition fees, foreclosures are the priciest intensive courses on personal finances out there.

When a (former) student loses almost all his/her earnings and savings after foreclosure, it’s like he/she’s been working in vain up to that point. It’s like those board games where you have to go back to the beginning if you fall on the odd number. Isn’t it frustrating? From this angle, it seems that foreclosures cancel years of productivity. By the end of the day, more than 2,000 Americans will have lost all the work they had invested in their dwelling. And it’s not entirely their fault!

So, doesn’t it make a lot more sense to increase our student’s productivity by educating them about the housing market? Of course, some private schools might offer financial education classes, but it needs to be taken seriously by public schools too. After all, the banking system awaits all of America’s children to get indebted sooner or later. Why don’t we value our children’s time and money? Have we forgotten that time is money?

Renting after foreclosure

In the US we have made the credit score part of our lives. It’s even more important than our security number or birth date. We identify with our creditworthiness. No wonder why a low score is so humiliating. According to ValuePenguin, the average FICO score is 695, and the average VantageScore stands at 673 in 2019. So, what does this three-digit number have to do with renting?

In the US we have made the credit score part of our lives. It’s even more important than our security number or birth date. We identify with our creditworthiness. No wonder why a low score is so humiliating. According to ValuePenguin, the average FICO score is 695, and the average VantageScore stands at 673 in 2019. So, what does this three-digit number have to do with renting?

Most landlords want to make sure that their tenants will pay the rent on time every month. That’s why they rely on various screening methods and may ask for a credit report. RentCafe found that the average credit score of approved renters in 2017 was 650, while those rejected had 538 points on average.

Isn’t it funny that when we finish our studies, we all enter the economy with a clean credit history as if we were experts at managing our income? In reality, before the first home loan, a good credit score stands for “no idea how to save and spend my money”! If our credit score reflects how good we are at making payments on time and planning our budget, then I think a low score should mean more experience, more financial maturity, and more responsibility. Yes, we all make mistakes, but we learn from them and move on.

Sadly, a foreclosure doesn’t make housing more affordable. It’s a long-term punishment that complicates our existence. Renting after foreclosure with bad credit has another set of challenges. You have to convince the landlords that you’ve learned your lessons. But how? By paying a higher security deposit, by finding a co-signer, aka rent guarantor or by coming up with a custom offer.

Another way to alleviate the landlord’s concerns when renting after a foreclosure is to suggest an automatic deduction from your bank account or offer to pay in advance. More and more landlords understand that behind a bad credit score there are well-intended people who deserve to be treated equally. Landlords also admit that renters with a high credit score are not necessarily the ideal tenants and shift their attention from creditworthiness to the steadiness of an applicant’s employment.

One more thing that you should try is to convince the new buyers that you can become their new tenant. It is very likely that your distressed property will enrich a real estate investor’s portfolio, so he/she will be more than happy to have a tenant without wasting time searching for one. Other buyers might offer cash for keys - they give you money to move fast, so that money will be like a breath of fresh air for you and should help you find a decent place to live. You have to be creative when renting after foreclosure.

Government help after foreclosure

Don’t expect too much from the Government after a foreclosure. If you are one step away from becoming homeless, local authorities will help you find a temporary place to stay.

Otherwise, the Department of Housing and Urban Development (HUD) can only advise you how to manage your income better, how to budget and prepare patiently for the next loan. A HUD-approved Housing Counseling Agency will assist you for free.

You will only be able to apply for a new mortgage after three years for FHA loans and seven years for Fannie Mae/Freddie Mac loans. If you qualify for government help after foreclosure, you should take advantage of it!

Low-income families and individuals may benefit from the following programs:

- Supplemental Nutrition Assistance (SNAP)

- The Special Supplemental Food Program for Women, Infants, and Children (WIC).

- Child Nutrition Program

- Medicaid

- Child’s Health Insurance Program (CHIP)

- Low-Income Home Energy Assistance Program (LIHEAP)

- Supplemental Security Income Program (SSI)

- Temporary Assistance for Needy Families (TANF)

- Earned Income Tax Credit (EITC)

- Federal Pell Grant Program

Most of these programs are designed for families or individuals under a certain income. So, you can choose to either limit yourself and maintain a low income to qualify for Government support, or take life into your own hands, fix the broken parts and aim higher.

How to rebuild your life after foreclosure?

Start by rethinking your personal finances. This is not rocket science. Stick to a monthly budget and don’t let any money float in your wallet without a clear destination. Forget about credit cards for a while and use only cash, as far as possible. To rebuild your credibility and to lower your credit risk, pay all your bills on time.

Start by rethinking your personal finances. This is not rocket science. Stick to a monthly budget and don’t let any money float in your wallet without a clear destination. Forget about credit cards for a while and use only cash, as far as possible. To rebuild your credibility and to lower your credit risk, pay all your bills on time.

The best thing that you can do next is to make saving money a top priority. This is the healthiest way to raise capital and increase your net worth. If you imagined that loans are here to make you rich, you were completely wrong. Loans exist to help you borrow from yourself, from your future earnings. You’ve been given money in advance and you have to repay it. Of course, you may say that loans were constraining you to save money, but you become richer by turning your debts into assets through monthly payments. In many countries (US included), banks only increase the gap between the rich and the poor. Another problem is that most Americans use loans to buy products that depreciate fast. Their “assets” are pretty much outdated before they make the last payment on the loans they used to purchase them. When you’ll save money for a whole year, you’ll think twice on what you’re going to spend it.

Split your savings so that some of it covers any outstanding balances and set up an emergency fund with the remaining funds.

Focus more on helping others, too! Increase your donations or sponsor several nonprofit organizations. Get more involved in your local community!

To increase your income, get a second job or start an online business! Do you think your story could help others in similar situations? Write a book about your experience or start a YouTube vlog to educate others!

You may also save money to start a business. There are plenty of businesses that you can start with very little or no capital, especially in rural areas. And to combine business and pleasure, you can start growing vegetables at home, cut flowers or pot plants, and livestock.

Don’t expect help from others after a foreclosure. Most people don’t understand how this whole process changes you. They don’t know how painful it is to see years of your work go down the drain… Help yourself instead and stay positive! You’ve only lost a house, a pile of bricks and mortar, and that is not the worst thing that could have happened to you! Let the past behind and focus on all the opportunities this life event has brought you. There’s plenty of life after a foreclosure!

Have a question or comment?

We're here to help.