Over the years, the landscape of the housing market has changed dramatically. As the older generation grows even older, a new group is coming into their own as the face of the housing market: millennials. These home buyers are faced with a new set of daunting challenges when it comes to buying a home, and realtors face an entirely different set of challenges when marketing to them.

In today’s market, the millennial must come to terms with a very hostile situation. Adjusting for inflation, wages are far lower than they were in previous decades, making purchasing a house upfront virtually impossible. Millennials buying homes are faced with ever mounting risks, and for those willing to take a chance, a near-perfect credit score is almost always required.

So how do millennials face these challenges? Are millennials buying homes at the same rate their parents and grandparents did? What are the best places for millennials to invest in? Here, we’ll go over what a millennial has to do in order to buy a house, and how millennials can face these difficulties in buying a home, as well as the effect they have on the real estate market as a whole. Let’s get into it!

Millennials and real estate: why aren’t they buying?

If you are a millennial and you’ve looked into buying a home in recent years, chances are you’ve been utterly floored by all the things you have to do in order to even think about buying your own home. High taxes, low wages and absurd credit requirements are all things that scare millennials away from home ownership; but why exactly aren’t millennials buying homes?

Wage stagnation

First off, let’s look at average wages. Although wages have increased significantly since the 1970’s and 1980s, the purchasing power of those wages has fallen dramatically as well. In 1985, you could expect to shell out around 3.5 times the amount of money you made in a year on a new home. Today, that figure is roughly 6.7 times the average yearly income.

There are many different causes to this, from decreasing college graduation rates to inflation, but the bottom line is this: it’s more difficult than ever to break into the housing market. With the cost of living constantly rising and wages rising at a much slower pace, the number of millennials buying homes is dropping lower and lower year by year.

Higher taxes

Further exacerbating the issue of wage stagnation is the problem of taxes. Since the 1970s and 1980s, taxes on the middle and lower classes have risen dramatically, with double digit percentage increases on the majority of taxpayers. When added to the already meager earnings of the rank-and-file populace today, millennials buying homes is something that happens less and less frequently.

Credit score requirements

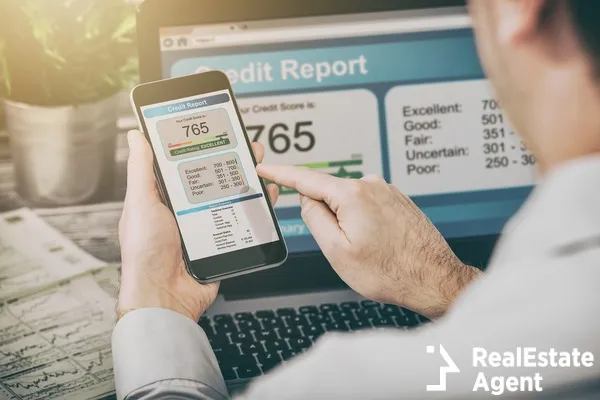

Now, considering the fact that most millennials would be forced to save for over a decade if they wanted to buy a home without finding a second job, the option most opt for is mortgaging a home. This seems like a reasonable choice; if you can save up a reasonably small sum, you can afford a down payment on a decent house and feasibly own it outright in 10-15 years.

But there are plenty of difficulties here as well. First and foremost, credit score requirements. To avoid a repeat of the 2008 housing market crash, most banks won’t consider offering a mortgage to anyone who doesn’t have a nearly perfect credit score. While there are certain things that can be done to improve one’s credit score, this is just another thing that stands in the way of millennials buying homes.

Rent costs

A supplementary difficulty for millennials trying to buy a home is the rising cost of rents across America. In large cities, rent prices can easily range from $1,200 a month all the way up to over $2,000. With such high rent costs, it’s virtually impossible to save the money needed for a down payment. Despite this, when it comes to buying vs. renting, the only option for many is renting.

Student loan debt

Statistics show that those with a college degree earn significantly more than those without in today’s economy. But how does one go about getting such a degree? For some, the family can assist with tuition and living expenses, but for most, the only option is a student loan. With high interest rates after graduation, most college students are still paying off student debt for years after they graduate.

Millennials in the real estate market

Now that we’ve discussed the various challenges that face millennials, let’s take a look at how they’ve affected the real estate market. As the newest, most populous group buying homes today, these home buyers are among the most influential in the real estate game today. Want to find out how they’re affecting the real estate market? Keep reading!

Decreasing home sales

Considering the challenges millennials face when buying a home, it’s no surprise that home sales to millennial buyers have brought the overall number of sales down significantly. Contrary to popular opinion among many older citizens, this is not due to a lack of work ethic or fear of leaving the nest. Rather, it’s simply the result of often insurmountable difficulties these individuals face when trying to buy a home.

Nevertheless, it could be said that, in this regard, millennials have had an overall negative effect on the housing market by driving down demand for homes. This is not to say that it’s their fault; rather, it’s simply the result of the state of the economy and the general state of affairs for this disadvantaged group.

Increased demand for a rental property

While millennial hesitance to buy houses has led to lower home sales, it has led to growth of the home and apartment rental market. When searching for accommodation, millennials are far more likely to choose a rental home or apartment over home ownership, due to job instability, lower wages and other factors discussed above.

For landlords with a property that can be rented out, this is obviously a net positive. The development of apartment and condominium complexes in densely populated areas has led to exponentially increased economic growth, as developed and undeveloped property values skyrocket.

For heavily urbanized areas, this has led to rapid growth and extensive expansion. As these areas reach their maximum occupancy cap, both home values and rent prices increase exponentially, as demand for housing increases and availability remains the same. In this regard, millennials have an overall positive effect on the market.

Conclusion

In the past 50 years, the real estate market has grown and changed in a variety of ways, as society continues to evolve. We live in a very different world from the one that our parents lived in 30, 40 or 50 years ago, and the evidence can be seen with abundant clarity in the real estate market.

There are those who say that the decline in the housing market is the fault of slothfulness or lethargy on the part of millennials. They say that millennials don’t want to work, or that millennials cling to the security of living at home for too long. But the truth of the matter is that the housing market is a much harsher place than it was in years gone by.

Simply speaking, it is nearly impossible to buy a home without either going into crippling amounts of debt, either to fund a college education or take on a mortgage with outrageous interest rates. The scales are stacked against millennials, more so than they’ve been against any other generation in recent memory.

The solution to the problem presented by decreasing home sales is debated by many. Some argue for higher minimum wages, others for increases in social aid or even the establishment of a universal basic income. What is the true solution? Only time will tell; it’s up to us to work together to find it.

Did you enjoy this article? Want to ask a question, or leave some feedback? Leave us a comment in the comments section below! Our readers are our top priority, and we value your feedback more than anything else, so you can count on us to get back to you in a timely manner.

Have a question or comment?

We're here to help.