Ever since childhood, I have seen the many faces of debt. A big statement, you might think, but my parents’ debt greatly impacted my life. When I look around, however, not everybody talks about debt as a dreadful experience. Why? Because they knew which loan to choose from so many different types of loans. And even if they have a hard time with their payments, they take all responsibility for their financial decisions. Not my parents - they always had to blame someone.

Ever since childhood, I have seen the many faces of debt. A big statement, you might think, but my parents’ debt greatly impacted my life. When I look around, however, not everybody talks about debt as a dreadful experience. Why? Because they knew which loan to choose from so many different types of loans. And even if they have a hard time with their payments, they take all responsibility for their financial decisions. Not my parents - they always had to blame someone.

I had moved seven times before I turned 30! Not a single day passed without my parents fretting about how they would pay the next installment. Phone calls from debt collectors became their main daily conversation. Constantly asking for deferrals increased the stress and the pressure in our household. I kept wondering why the banking system shows so little compassion. Why does it matter if you need an extra year or two to repay the loan? Then, I remembered a line from a heartbreaking scene in Never let me go: “There are no deferrals. And there never have been.”

Because I couldn’t find a satisfying answer, and because I was intrigued by the lack of empathy, I kept digging. This article is not going to be just another boring paper that seems like a financial law course written by a Professor that sits comfortably at the top of all academic ranks. This article is going to strike you and will make you wonder what is REALITY after all? There is a strong link between different types of loans and the reality we perceive. In the following paragraphs, I will take you in the backstage of the banking system - a place you must explore with an open mind.

The truth about loans is not on Google

After studying economics, both in college and independently, I have arrived at a conclusion which I couldn’t find on Google. I believe that loans are a means of altering reality. Many things that surround us would have never come into existence if a loan had not been pumped into the economy. Things like your neighbor’s car (he might have an auto loan), your apartment or house (you probably have a home loan), your TV and smartphone (purchased with an appliance loan), even the roads you drive your car on - all are the fruits of debt. Yet debt becomes reality itself. So it is fascinating to watch how debt is changing reality and becomes itself a new tangible reality.

After studying economics, both in college and independently, I have arrived at a conclusion which I couldn’t find on Google. I believe that loans are a means of altering reality. Many things that surround us would have never come into existence if a loan had not been pumped into the economy. Things like your neighbor’s car (he might have an auto loan), your apartment or house (you probably have a home loan), your TV and smartphone (purchased with an appliance loan), even the roads you drive your car on - all are the fruits of debt. Yet debt becomes reality itself. So it is fascinating to watch how debt is changing reality and becomes itself a new tangible reality.

Different types of loans turn into different goods. They are a liability and an asset at the same time because you can use that debt, you can touch it, you can interact with it. It has a shape. You borrow from yourself, from your future earnings, to enjoy something way sooner than if you would have saved every month. An appliance loan will buy you a new dryer or a dishwasher. A car loan will get you a new car. And a home loan will provide you and your family a roof over your head. This is microeconomics.

From a macroeconomic point of view, there are different types of loans that change our economic reality beyond our understanding. The U.S. government's public debt has reached its highest level in history - $22 trillion, according to NPR - a third of the world's total debt. Actually, if you haven’t heard of the National Debt Clock, you should know that this is the idea of real estate developer Seymour Durst who felt that something is wrong with this number and wanted to highlight it. It still works today, in New York, on the walls of One Bryant Park. But it does little more than displaying an ever-increasing number.

Don’t you find it strange that you, as an individual, have to live within your means, making ends meet every month by counting every single dollar, while the government doesn’t seem to care how much it spends every month? Central administration always relies on borrowing and there is no credit score to limit the amount of national debt. But our government’s debt becomes our reality too. If the government/state borrows money to build a highway, then we will soon drive on that highway, so our national debt will provide something useful for everyone. Consequently, we will pay a toll to cover building costs and maintenance. The US might have a large debt, but we all benefit from the new shape of our reality. Not only at the macroeconomic level, but at the household level as well.

When “unaffordable” becomes “affordable”

How do different types of loans impact our economy? By cutting the first two letters from “unaffordable”.

How do different types of loans impact our economy? By cutting the first two letters from “unaffordable”.

Most of the time when you go out shopping, you have to ask yourself: “can I afford to buy this and that”? If you go to Walmart and need to buy a loaf of bread, but you don’t have enough money, it means that you can’t afford it. You have two options: either to leave it there or to pay for it with your credit card in which you borrow some money from a bank to buy a loaf of bread. Now you see how loans make all things affordable?

Nevertheless, if the government must build a highway, and doesn’t have enough money, though, it doesn’t mean it’s unaffordable. For the government, it merely means they have to borrow some money. Affordability never comes into question. No project is impossible to fund. The government will borrow money from someone and will pay interest. (Yes, there are people who invest in government bonds.) But, in the end, when the government must return the money and interest to the investors, you become the source of cash, although the truth is that you’ve used the reality generated by that borrowed money too!

Why people invest in bonds? For the interest these financial instruments generate. Interest is easy money - money they don’t have to work for. But, in reality, someone like you has worked hard for that money. So your hard-earned money becomes someone’s interest.

It’s the same in banking. In fact, different types of loans charge different interest rates. It depends on how much money you borrow from your future and how slow are you going to pay it back.

Who doesn’t want to make money without working? One way to obtain cash without working a.k.a. interest is to behave like a bank or to become a hard money lender. Until you find a way to make money easier in your sleep, this is a great option if you have the extra funds.

Unfortunately, nobody speaks out loud about the intention of paying off that huge sovereign debt or to reduce its burden. And nobody cares how big it gets. It has to get big, probably, because high levels of debt are associated with a “booming” economy, with capitalism, with developed societies. No bank has ever complained that people borrow too much money! The number of borrowers has never been a problem, but their quality has been. Subprime borrowers were the cause of recession more than 10 years ago.

Banks want us to borrow money and protect us by limiting the amount of debt that we sign for. Most lenders will analyze your debt-to-income ratio before you request a new loan and if it is over 43%, you will get a negative response. Ideally, you should keep your debt below a third of your income.

With so many different types of loans on the market, affordability is an old-fashioned idea. Nobody has the time to ponder a purchase in front of a Black Friday promotion. And this is human nature: if we want something, we must have it right then and there. So the banks aim at the core of our weaknesses and try to erase the idea that something could be “unaffordable” or “too expensive” by playing with words better than Shakespeare.

Loans are the perfect answer to any need and desire. And as you can see, most banks use happy couples and smiling faces whenever they talk about debt. “Debt is fun! Debt is easy!” - That’s what they try to convey. Living with my parents made me believe that debt is bad and harmful. Now, after moving out of their house, I know that it is my job to make debt easy and fun for me and for my family. That means to borrow only what I can afford to pay back.

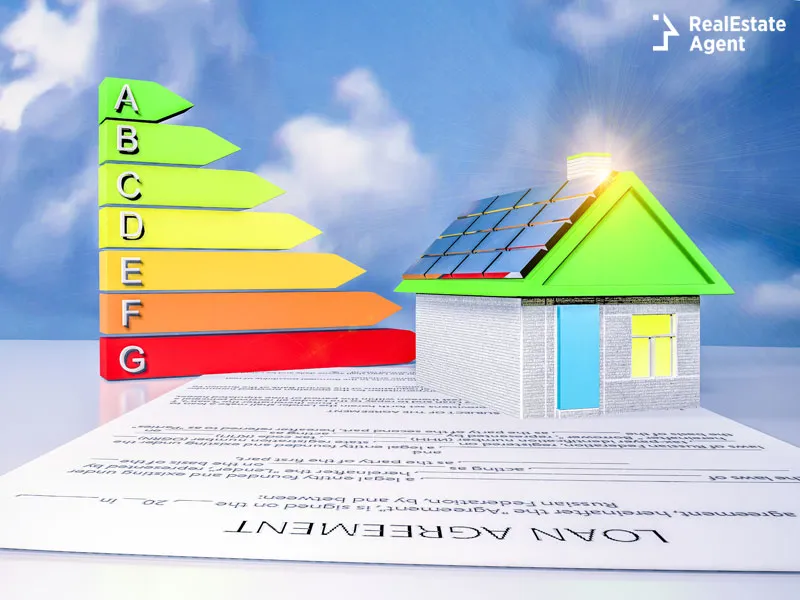

For example, a home loan is a major decision for many, especially after getting married. Newlyweds don’t want to live with their parents so they leave their nests and move alone. With a stable income, buying a house is better than renting, especially if the rent is similar to the monthly payment on a mortgage. So a home loan is making housing more affordable for those who do not have all the money in cash. But even those who could afford to pay a house fully in cash prefer to borrow and pay slower than to pay so much money at once.

It is still true that loans alter reality and change the environment - new residential buildings, new commercial buildings, new single-family homes and the like - all are built with loans. Then, these buildings become the generators of more loans. For example, residential buildings will force banks to come up with various types of home loans (mortgage loans). Commercial buildings will generate more small business loans and lines of credit that will change the balance in the market, generating a fake demand and increasing the prices, thus causing inflation. We just have to accept that this is how the economy has been working for the past centuries. Whether the new reality is good or bad depends on us, on what do we borrow the money for.

The generators of different types of loans

Banks are the primary generators of debt. A parallel indebting system is the Stock Market, which is way too complicated and hard to understand for the ordinary people, even though it works on the same principles.

Banks are the primary generators of debt. A parallel indebting system is the Stock Market, which is way too complicated and hard to understand for the ordinary people, even though it works on the same principles.

Banks are the heart of the economy. Loans are very stimulating and many would never be able to save money without a loan. But a loan keeps them motivated and keeps them working. It gives them a purpose and a dream. The American dream…

Banks make money by creating financial products such as deposits and loans. The latter is the main source of profits. Loans come in all shapes and sizes and have different costs. Borrowers have to pay various commissions, taxes and a fixed or variable interest to the bank for using a loan. There is a loan for every imaginable need and desire - go back to Maslow's hierarchy of needs again - a lesson so little understood by most students. But where is the line between serving a human need and exploiting it?

It is the borrowers’ responsibility to distinguish between NEEDS and WANTS. For example, when you buy a house, you cover a need. When you buy the latest model released by Tesla, you cover a want.

A loan is the economic embodiment of human greed when it only serves the wants and desires of the borrower. Do you think that our great grandparents didn’t have dreams? Do you think that they never imagined things that could change the world? Then why were they less indebted than us? Because they had fewer temptations.

Besides this, they had no electricity and no computers. I would dare to say that banking is a recent invention. Debt needed electricity and computers to grow. Electricity was discovered and introduced at the beginning of the 19th century. In 1878, Thomas Edison invented the light bulb. The first programmable computer was created by Konrad Zuse from Germany, between 1936 and 1938. Now, what do these dates have to do with the banking system? If you ever read the history of banking, you will see that the banking system, as we know it today, started its boom right after these two significant inventions. Before electricity and computers, all accounting was carried on paper and handwritten. Today, it would be almost impossible to keep track of everybody’s principals and interest owed on so many loans at a particular time without the use of computers.

Electricity and computers are not bad inventions if you use them for good purposes. Banking is good as long as it doesn’t cause over-indebtedness. So if we treat banks like any other invention, they are good as long as we don’t abuse them. They will try to tell us when to stop, but we have to STOP in time. The Truth in Lending Act of 1968 is another attempt to protect consumers from contracting expensive loans. Regulation Z allows borrowers to change their mind within 3 days of signing for a loan, also known as the right of rescission.

The bank does absolutely nothing in exchange for the interest, but to play the middleman’s role. It takes its depositor’s money and converts it into loans, and as you will see, everything is done on the keyboard. People keep their funds in savings accounts or deposit accounts, which in turn is lent to whoever is short of cash and needs to buy something. This is how the business works and there is little we can do to change it. Borrowers have to play by the rules.

Debt is good if you prepare for it

I find it hard to understand why our education system fails to equip students for adulthood. Many would have done a lot better, including my parents, had they been taught debt management and the basics of budgeting before graduating from high school, or at least before their first salary.

I find it hard to understand why our education system fails to equip students for adulthood. Many would have done a lot better, including my parents, had they been taught debt management and the basics of budgeting before graduating from high school, or at least before their first salary.

When it comes to real estate, real estate agents have a crucial role in educating future home buyers and sellers about the different types of home loans available. Real estate agents learn a lot as they prepare for the State exams so they can bridge the gap between the national curriculum and real life.

Communication is crucial! Real estate vlogs are a great way to inform people about the pros and cons of different types of loans. Vlogs help with personal branding, with building trust and confidence, and with building an audience. But when you explain all the types of home loans, you also make the dream of owning a home more affordable. As a real estate agent, you never know when one of your viewers might call and sign a contract with you!

Real estate agents have an obligation to clarify the macroeconomy so that the homebuyer gets a clear picture of his role in the economic process. Any loan or mortgage loan is an important decision, and it is a great responsibility. Those who get a home loan should see it as a way of leaving something to their children so that they don’t have to go through the same process again. In real life, parents will do everything they can to pay off the house. In return, children may have to take care of their parents and help them pay their bills when the old age takes its toll, even though they will no longer live together. After all, children will inherit a property that will hopefully provide passive income for many years.

Debt is good when it is shared, especially off the record, among the family members but young adults don’t have the maturity and the ability to cover their parents’ shortages. I fell in the trap of blaming my parents for their debt instead of helping them out. But I was young, and I had nobody by my side to give me a bit of good advice. I wish we could start over…

My idea of sharing debt is not the same as cosigning a loan and might cause you to raise an eyebrow. It is more informal - a mutual agreement between parents and children, husband and wife or even bosom friends. Contributing to someone’s monthly payments during the life of a loan or for a short time is a way of making debt easy, good and manageable. But it requires a lot of maturity and trust. The type of debt you are covering is also important: is it a mortgage or gambling debt? For example, parents can’t wait to cut the financial cord for their children, but 9 out of 10 parents would bail their children out with a gift or a loan, according to a poll from CreditCards, but won’t cover any type of debt.

Classification of loans

Given the fact that the banking system is strictly monitored and regulated, it might seem rigid at first. But all’s well that ends well, so if you comply and adjust your monthly budget, you should be fine. I know you find it strange that the bank would give you a massive chunk of money, all at once, paying the home seller, for example, and in return, they expect you to repay the money over a long period of time, without missing a payment instead of returning a lump sum over 30 years. So, if you need a loan, you will have to accept the terms of the contract.

Given the fact that the banking system is strictly monitored and regulated, it might seem rigid at first. But all’s well that ends well, so if you comply and adjust your monthly budget, you should be fine. I know you find it strange that the bank would give you a massive chunk of money, all at once, paying the home seller, for example, and in return, they expect you to repay the money over a long period of time, without missing a payment instead of returning a lump sum over 30 years. So, if you need a loan, you will have to accept the terms of the contract.

Do you dislike the rules? Stay out of debt! Pretty simple! Debt management is hard, and not everyone knows how to play with the numbers. You don’t have to sign a mortgage contract! Believe me or not, though, a good real estate agent can make you change your mind after explaining how mortgage loans work. It’s all in your favor!

So why are there so many different types of loans? Because there is literally a loan for every need and dream: for the need to cover for your food and utilities, to the dream of becoming a real estate investor. Since everyone has a different income and a different plan for the future, this huge variety of financial products is not surprising at all.

There are two types of credit: open-end credit and closed-end credit.

Open-end credit is the kind of loans that you can access again and again as long as you make the payments on time. They are also referred to as revolving credit. In this category are included credit cards, home equity loans, and home equity lines of credit (HELOC).

Closed-end credit finances a clearly defined purpose for a specific period of time - also known as installment loans. If the borrower fails to make the payments on time or skips payments, the lender has the right to sell their property to recover the money — examples of closed-end credits: mortgages, car loans, payday loans, and appliance loans.

Now, there are loans for consumers, for the average person, and loans for entrepreneurs of all sizes or corporate loans.

But home loans are very profitable, if not the most profitable type of loan. Not only it spreads over the whole active adult life (25 to 30 years), but it also generates huge interest which can exceed the initial amount credited to the borrower.

Types of mortgages

Before we talk about the different types of mortgages, you have to understand the market first. Mortgages are sold in two markets: the primary market and the secondary market. The primary market is where demand meets the offer or borrowers meet the lenders (banks, credit unions, mortgage bankers and brokers).

Before we talk about the different types of mortgages, you have to understand the market first. Mortgages are sold in two markets: the primary market and the secondary market. The primary market is where demand meets the offer or borrowers meet the lenders (banks, credit unions, mortgage bankers and brokers).

For a mortgage to be sold on the secondary market, it must meet several criteria so it must be a conforming loan. Why? Because when a bank sells a mortgage, it actually receives funds. But the buyer doesn’t want any kind of mortgage, and definitely not a subprime mortgage. The big players on the secondary market are Fannie Mae (Federal National Mortgage Association or FNMA) and Freddie Mac (Federal Home Loan Mortgage Corporation or FHLMC). So, when the banks run out of money, they rely on the secondary market for funds that will allow them to contract more mortgage loans. Fannie Mae and Freddie Mac turn mortgages into mortgage-backed securities (MBS) and sold to all kinds of financial investors (pension funds, insurance companies, hedge funds). Other players on the secondary mortgage market are The Government National Mortgage Association - Ginnie Mae, and Farmer Mac - The Federal Agricultural Mortgage Corporation. If you have a home loan and it was sold on the secondary market, you will still pay your monthly payments as usual, but the bank will redirect the funds to the buyer from the secondary market after it retains its commission.

Fixed-rate mortgage loans are preferred over the adjustable-rate loans. In the US, the most popular is the 30-year fixed-rate mortgage, according to the Mortgage Calculator. Mortgages are for real estate agents what good frying pans are for the chefs - tools of the trade. So why should you work with a real estate agent? Because (s)he knows how to make things happen. Unfortunately, most buyers do not know how many types of home loans there are and how they can benefit from them. Becoming a homeowner for the first time is not such a far fetched illusion when you look at all the following options.

Here are the main types of home loans you can choose from:

FHA loans

The Federal Housing Administration insures loans made on the primary market through the 203(b) loan program. The main advantage of these loans is the very low down payment required, so these loans usually have a very high loan to value ratio.

VA loans

The Department of Veterans Affairs (VA) sets the eligibility rules. VA ensures these mortgages so there is little chance for the borrowers to ever default on them. The loans may require little to no down payment.

FSA loans

The Farm Service Agency (FSA) focuses on developing rural areas. It guarantees loans made by primary lenders and lends money directly to borrowers.

Blanket mortgage

Real estate investors are very familiar with this type of loan. It facilitates the building process and the sale of a property that is part of a subdivision. Investors are more interested in the partial release provision.

Construction loan

When someone hires a builder to build a house, the money is paid directly to the builder. So the bank pays after a stage of construction is completed. This type of loan is difficult to get due to the fact that the collateral (the house) is not yet built. Banks might accept the land as collateral, but if its value doesn’t cover the loan, the owner still has to pay the difference in case he defaults. The downpayment is usually very high - 20-25%. This is a short-term loan, but when the project is finished, this loan can be refinanced and turned into a regular mortgage loan.

Home equity loan

As soon as you own more than you owe in your property, you can access a home equity loan for a major repair, for health issues or to pay for college education. You can opt for a closed-end credit or an open-end credit, choosing a line of credit. Home equity loans are a second mortgage because you have to put your house as collateral for the loan.

Open mortgage

When you have an open mortgage it means that you can pay more from your principal every month, to reduce the interest on the loan, without a prepayment penalty. Closed mortgages do not allow payments of the principal that exceed the monthly amortization without penalty.

Open-end mortgage

The particularity of this type of mortgage is that after a certain amount of the loan is paid back, the borrower can access the same loan amount again. It is a revolving loan.

Package mortgage

A type of loan that covers real estate and personal property. Usually, it is used to buy fully furnished houses, like a second vacation home.

Purchase money mortgage

When a home buyer cannot qualify for a mortgage, the seller of a house might help him/her. The seller issues a (second) mortgage to the buyer. It happens when the buyer has $50,000 for the down payment but qualifies for a mortgage of a maximum $120,000. Now, if the seller asks $250,000 then the buyer can benefit from the $80,000 mortgage in order to close the sale.

Reverse mortgage

This is not a home loan. Reverse mortgages are also referred to as reverse annuity loans. This is a very interesting concept and might prove very useful for older people with or without disabilities. This type of loan allows the owner with high equity in a property, to use it without selling the home. The best part is that a reverse mortgage does not require monthly payments as long as the borrower lives in that home. However, only people age 62 or older have access to this kind of mortgage. How will the lender recover the money from a reverse mortgage? By selling the property when the borrower dies or moves.

Sale-leaseback

In a sale-leaseback, the homeowner sells the property and signs a long-term lease contract with the new owner. This is a great idea for real estate investors who are looking to buy a property but don’t want to waste time looking for tenants. It works well in commercial real estate as well.

Shared equity mortgage

When money is short, a home buyer can request the money for a down payment from a relative, a real estate investor, or a lending institution in exchange for a predetermined share of the profit when the property will be sold. A little compassion goes a long way!

Temporary loan (interim financing / bridge loan / gap loan)

When a home seller finds a client for his/her property, it usually takes a while for the property to be transferred and the seller might not get the money until the very end. If the seller wants to buy a new house using the money resulted from the sale, then he/she can access a bridge loan - a short term loan that is paid back soon after the seller receives all the money for his/her property.

Wraparound mortgage (“Wrap” / Piggyback mortgage)

This is a second mortgage, too. This kind of secondary financing is used to absorb an old mortgage when the seller of a property does not pay an existing mortgage at the time of sale. According to The American Bar Association: “The face amount of the note and mortgage is the aggregate of the outstanding first mortgage principal and the additional amount advanced.” As long as the borrower makes the payments in due time for both mortgages, the lender will be happy.

What is a hard money loan?

This option is a riskier type of loan and it is offered by private individuals or institutions, at interest rates as high as 12%. It is a short term loan that is based on the value of the collateral, not influenced by the borrower’s credit score. Funds provided could be between 65% and 75% of the current value of the property, according to Wikipedia. Borrowers have to repay it fast, from a few months up to a year or two. On the one hand, as a loan of “last resort”, landlords use it to save a property from being foreclosed upon. On the other hand, fix-and-flip investors use them to renovate a house and resell it for a profit. Hard money loans are more common in the United States and Canada among those who have high equity in their commercial or residential properties.

Private lending is an alternative to the stock market. Huge interest rates are seductive for those who are looking for a high yield investment and with the help of a good lawyer, hard money lending can be a very rewarding business. Virtually, there is little risk for the lender. The best place to find the first borrower is the local Real Estate Investment Club.

What is a second mortgage?

I have specified that certain types of loans are second mortgages. What does it mean? It means that under the main mortgage that is still in effect appears a subordinate mortgage. So a person has two loans that have the same property as non-cash security. The second loan is usually smaller but more expensive since the credit risk is greater. For example, if the borrower defaults on the original mortgage after the property is sold, the funds are used to pay the first mortgage lender and the remaining funds will cover the second mortgage lender. A second mortgage is used for large purchases: for a new car, for the college education, or for debt consolidation. However, be careful when switching from unsecured debt (which might carry higher interest rates but there is no risk of foreclosure on your house) to a consolidation loan (which increases the risk of losing your house).

Conclusion

Do you want to live a happy life? Try to keep your level of indebtedness as low as possible. The higher your debt level, the more stressed you become. According to a 2017 survey released by the American Institute of CPAs (AICPA), 56% of indebted Americans say that debt has a negative impact on their lives. Outstanding household debt is over $12 billion. Almost a third of Americans say that debt has turned not only into financial difficulty but into a mental burden as well. When asked how they feel about paying off their debts, more than 39% reported they feel anxious. Behind closed doors, debt is causing tensions in relationships. Financial problems are a cause for divorce, for sure.

Many fail to realize that banks use (deceiving) marketing tricks to sell “their products” like any other business. So far, they managed to divert the public’s attention from the dark side of debt. But it is there and you must see the whole picture before you decide for yourself.

What I find hilarious is how people hurry to get indebted and soon thereafter struggle to find a way out of debt. When you enter the debt maze with different types of loans remember that you are not alone. There are many Americans in the same boat with you. But the maze of debt is not about the destination. It’s about the journey. Try to enjoy your life as you turn all your debts into assets.

Have a question or comment?

We're here to help.