Mortgage Amortization

The term mortgage amortization is the steady switch occurring to each mortgage payment between how much interest is covered and how much principal each month. Simply put, mortgage amortization is the plan for repaying a mortgage. Because the debt diminishes with each payment, the interest diminishes, and because the interest decreases monthly, the principal coverage increases with each payment.

The Mortgage Amortization Definition

Amortization is the way through which mortgages are repaid. This feature can be applied to mortgages with an equal monthly payment and a fixed timeline. Mortgages, as well as other loans, can be amortized.

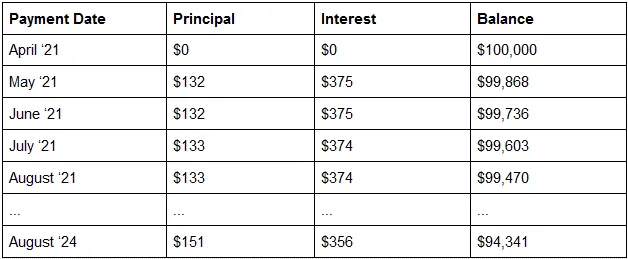

Let’s see this through a more practical explanation. The trademark of an amortized mortgage or amortized loan is the shift from paying mostly interest every month to mainly paying principal every month. The math goes like this: for a $100,000 mortgage with a 4.5% interest rate, amortized over a span of 30 years, the fixed monthly payment totals at $507. In this value, during the first month, we will see that $375 goes to cover the interest, and the remaining $132 covers the principle. Towards the mortgage’s mid-term, there is a switch with $249 going to the interest and $257 to the principle. The last mortgage payment will be split into $2 for the interest and $505 for the principal.

How does Mortgage Amortization work?

Mortgage amortization is a repayment plan that uses an amortization table or amortization schedule as a way to visualize the concept. An amortization schedule is a grid or table showing how payments are split between the interest and the principal, and the balance that remains after each payment. Below you can see how mortgage amortization works in time.

With mortgage amortization, after four payments, the balance reaches $99,470, and in 3 years, the balance is $94,341. An amortized mortgage is a loan where the balance decreases gradually at first and more abruptly in the final years. Similarly, equity is built slowly at first but more rapidly in the last years.

Popular Real Estate Terms

The term’s abstract of title definition is the recorded summary of a property’s history. Abstracts of title can be used to determine former and present ownerships of any ...

Obligation taken on by a person who did not obtain it originally, but agrees to honor the terms of the existing obligation as a condition for the transaction. By assuming the loan rather ...

If you are involved with real estate, chances are you've come across the term "convey" or conveyance. But what does convey mean in real estate? This term is crucial whether you're buying, ...

Rent that a comparable property would mandate in a given real estate rental market. Market rent is a competitive rate based on rents other comparable properties receive. For example, in a ...

unfinished access space below the first floor having less height than a full story. An individual must crawl through the crawl hole to gain access. Any interior passage of limited ...

Thin layer or slate of baked clay, linoleum, or some other material that is used for covering floors, roofs, or as an ornament in a building. ...

Before getting a loan to buy a property, you must know the definition of foreclosure. A foreclosure is the process of making a loan due immediately. Technically, a loan becomes due way ...

The total expenditures required to make a locality suitable for the designated purpose. An example is how much it would cost to build a shopping center on a lot. ...

Area that is located between a rural and urban area. ...

Have a question or comment?

We're here to help.