Coefficient Of Dispersion

The coefficient of dispersion is how municipalities can determine differences between the assessed values of properties in an area or neighborhood. It gives a broader look at the state of the market, and a way to evaluate how consistent the appraisal of the properties is. The definition of the coefficient of dispersion that is used exclusively in dealing with market values and properties is a measure of how much values of a particular variable vary around the mean or median. The end value is represented in percentage from the median.

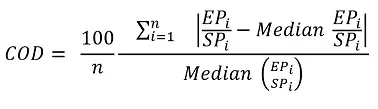

The Coefficient of Dispersion’s formula:

COD = coefficient of dispersion

N = number of properties in the sample

EPi = appraised value of ith property

SPi = sale value of ith property

∑ = summation of all the values in the group

How to Calculate the Coefficient of Dispersion?

After that insane formula, we understand if homeowners want to stay clear of it, but there are reasons why any homeowner would want to use it. If, for example, you’re house was appraised at a value that is higher than you expect, and the same happened to other neighbors, you can figure out if this is a trend in the area to increase taxes or just the increase of the market value in the area.

Example:

John investigated and managed to find the appraised value of 7 properties around him as well as the actual price for those properties.

|

Appraised Value |

Sales Price |

|

359,000 |

370,000 |

|

362,000 |

373,000 |

|

347,000 |

358,000 |

|

329,000 |

340,000 |

|

384,000 |

396,000 |

|

372,000 |

386,000 |

|

395,000 |

396,000 |

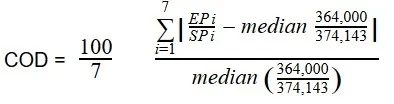

Now, John finds out the median appraised value by adding all the appraised values, then dividing it by seven properties ($362,000) and does the same to the median sale price ($373,000). With these values, he can start using the formula.

The median appraised value divided by the median sale value is 0.9729.

John returns to his table to discover the EPi/SPi for each property because the ∑ requires him to discover that value independently for each before he subtracts 0.9729 (the median EPi/SPi) from each:

|

Appraised Value |

Sales Price |

EPi/SPi |

|

359,000 |

370,000 |

0.9702 |

|

362,000 |

373,000 |

0.9705 |

|

347,000 |

358,000 |

0.9692 |

|

329,000 |

340,000 |

0.9676 |

|

384,000 |

396,000 |

0.9696 |

|

372,000 |

386,000 |

0.9637 |

|

395,000 |

396,000 |

0.9974 |

With that out of the way, John needs to subtract 0.9729 from each value. Here he considered negative values positive:

|

Appraised Value |

Sales Price |

EPi/SPi |

EPi/SPi-0.9729 |

|

359,000 |

370,000 |

0.9702 |

0.0027 |

|

362,000 |

373,000 |

0.9705 |

0.0024 |

|

347,000 |

358,000 |

0.9692 |

0.0037 |

|

329,000 |

340,000 |

0.9676 |

0.0053 |

|

384,000 |

396,000 |

0.9696 |

0.0033 |

|

372,000 |

386,000 |

0.9637 |

0.0092 |

|

395,000 |

396,000 |

0.9974 |

0.0245 |

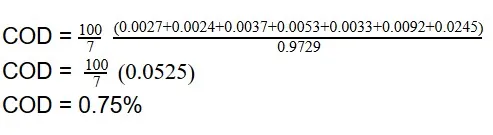

Now that he has all the data necessary, John can work the formula:

The coefficient of dispersion is a complex formula but the example above tells us that the average difference the houses have from the median of the assessed sales ratio is 0.75%.

Popular Real Estate Terms

The term’s abstract of title definition is the recorded summary of a property’s history. Abstracts of title can be used to determine former and present ownerships of any ...

Obligation taken on by a person who did not obtain it originally, but agrees to honor the terms of the existing obligation as a condition for the transaction. By assuming the loan rather ...

If you are involved with real estate, chances are you've come across the term "convey" or conveyance. But what does convey mean in real estate? This term is crucial whether you're buying, ...

Rent that a comparable property would mandate in a given real estate rental market. Market rent is a competitive rate based on rents other comparable properties receive. For example, in a ...

unfinished access space below the first floor having less height than a full story. An individual must crawl through the crawl hole to gain access. Any interior passage of limited ...

Thin layer or slate of baked clay, linoleum, or some other material that is used for covering floors, roofs, or as an ornament in a building. ...

Before getting a loan to buy a property, you must know the definition of foreclosure. A foreclosure is the process of making a loan due immediately. Technically, a loan becomes due way ...

The total expenditures required to make a locality suitable for the designated purpose. An example is how much it would cost to build a shopping center on a lot. ...

Area that is located between a rural and urban area. ...

Comments for Coefficient Of Dispersion

COD example unclear

Jan 15, 2023 09:18:18Hello. Let us shed some light on this.

Someone wants to find out the appraised value of several properties around them. and the sale price is higher. Then they discover the median appraised value ($362,000). They add all the appraised values of all the properties and divide them by the number of properties. And later does the same with the median sale price ($373,000) The median appraised value divided by the median sale value is around 0.9. Then, they calculate that the average difference between houses and the median is 0.75.

Jan 20, 2023 09:22:24Have a question or comment?

We're here to help.