Consumer Price Index (CPI)

The definition of the term Consumer Price Index or CPI is the measurement of the rate of inflation or deflation according to a weighted market basket of goods and services that includes such items as transportation costs, health care costs, housing costs, and food costs. These statistics are released monthly by the United States Bureau of Labor Statistics.

In other words, we could look at the CPI as an average of the prices of goods and services commonly bought by families in urban areas. This indexes the most well-known inflation gauge and is often referred to as the cost-of-living index, to which labor contracts, rents, and social security are tied to.

What is the Consumer Price Index Used For?

The CPI measures the cost of buying a fixed bundle of goods that are representative of the purchase of the typical working-class, urban family. It is also known as an economic indicator. While inflation is a decline in the purchasing power of the money, a climb in prices, deflation is the increase of purchasing power and decrease of prices. Both of these can negatively impact a healthy economy. With the help of the CPI, citizens, businesses and the government can get an idea of price changes throughout the economy that will give them the tools to make informed economic decisions. This index is also used to verify people’s eligibility for government assistance programs and provides cost-of-living wage adjustments for US employees.

The index excluding volatile energy and food costs is often called the core rate of inflation. The base year for the CPI index was 1982-84 at which time it was assigned 100. So, if the CPI is at 100 that means that it reverted back to the inflation levels of 1984. These statistics allow economists to understand changes in the economy when compared to any other period in the past. The CPI is important to landlords because it helps keep the base monthly rent in pace with inflation. The monthly rent will increase in a percentage equal to the increase of the CPI figure.

Calculating the Consumer Price Index

The Bureau of Labor Statistics (BLS) of the U.S. Department of Labor publishes the CPI figures around the 18th of each month. They reach the CPI figure by looking at the cost of a basket of goods and services during a specific month and dividing it to the cost of the same basket the month before. In order to do this the BLS records around 80,000 items monthly through information from various service providers across the country. Once the calculation is complete, the best outlook for the CPI is determined.

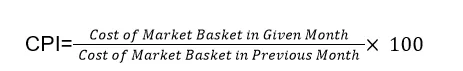

The consumer price index for one item is determined through the following formula:

This formula makes it possible for the BLS to know how much prices changed since when the index was first determined in 1982. If we look at the consumer price index calculated for March of 2022 at 264.8, we can say that since 1982, there has been a 164.8% increase in prices. However, when it comes to the percentages that really matter for today’s economy, we look at a 1.2% increase between February and March and an 8.2% increase over the last 12 months.

Economists also use other calculations to establish the state of the economy. The Gross Domestic Products (GDP) for example, determines the value of the products and services of one country during a given year.

Popular Real Estate Terms

Prepayment to a landlord for refurbishing the unit beyond what would be anticipated from customary wear and tear. It is like a damage deposit. The security deposit may be refunded at the ...

Property devoted to only one such as a medical building. ...

Tank placed beneath the ground to accumulate sewage. ...

Span of time a rental agreement is free to the occupant. A landlord may offer this as an incentive to stimulate rentals. For example, an owner of an office building may provide a free ...

The definition of obligor is a position that comes from obligation and indicates a party that has ‘promised’ to perform a specific act. In the financing world, an obligor is ...

(1) Judgment against a defendant who does not respond to the plaintiffs lawsuit or fails to appear in court at the hearing or trial date. (2) Judgment issued by the court against the ...

Mock closing; all information is available prior to an actual closing in order to insure all documents are properly executed by the appropriate parties. A preclosing is normally used only ...

(1) Judges remark in a court ruling not in and of itself embodying the law. A dictum merely illustrates or amplifies the ruling. (2) Arbitrator's ruling. ...

Same as term REIT: Type of investment company that invests money in mortgages and various types of investment in real estate, in order to earn profits for shareholders. Shareholders receive ...

Comments for Consumer Price Index (CPI)

Should commission schedules be adjusted as CPI changes?

Jan 09, 2019 17:30:29According to the U.S. Department of Labor CPI released in November 2018, the all items index increased 2.2 percent for the 12 months ending November. Now it is up to every real estate broker to decide if they want to change their commission schedule based on this. The average inflation of the United States in 2018 was 2.49 %. A slight increase in your commission schedule should not surprise anyone, especially in the first month of the year. But maybe you want to check on your competitor's approach, too.

Jan 10, 2019 04:14:47Have a question or comment?

We're here to help.